Which of the Following Best Describes a Monte Carlo Simulation

Monte Carlo Simulation also known as the Monte Carlo Method or a multiple probability simulation is a mathematical technique which is used to estimate the possible outcomes of an uncertain event. Monte carlo simulation ensures that a the simulated.

Monte Carlo Simulation Overview Vortarus Technologies Llc

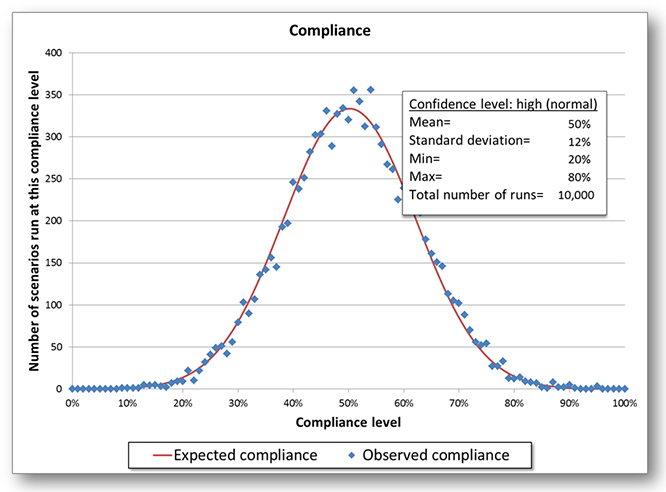

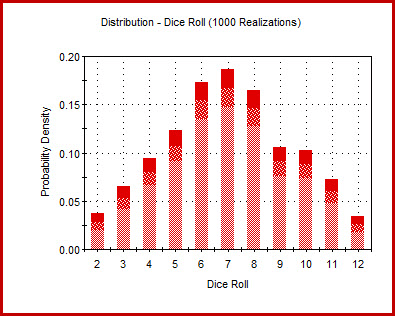

Monte Carlo Simulation is a mathematical method for calculating the odds of multiple possible outcomes occurring in an uncertain process through repeated random sampling.

. The random variables or inputs are modelled on the basis of probability distributions such as normal log normal etc. Only one uncertain decision can be in any simulation model C. This includes analyzing business processes and methodologies including our own.

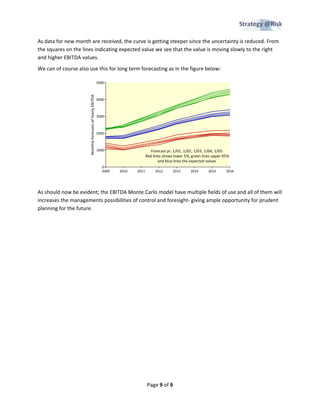

How long before an investment will pay for itself. By Monte Carlo simulation in trading you get a better understanding of the risk and. It then calculates results over and over each time using a different set of random values from the probability functions.

Which of the following statements most accurately describe an appropriate step in the Monte Carlo MC approach for measuring risk. The system may be a new product manufacturing line finance and business activities and so on. Monte Carlo simulation is a technique used to study how a model responds to randomly generated inputs.

Monte Carlo simulation is a statistical technique by which a quantity is calculated repeatedly using randomly selected what-if scenarios for each calculation. This method is used by the professionals of various profiles such as finance project management energy manufacturing engineering. Measure the value-at-risk VaR for the portfolio of these assets based on the simulated outcomes.

B It is a collection of techniques that seeks to group or segment a collection of objects into subsets. Monte Carlo simulations help to explain the impact. A Monte Carlo simulation is a quantitative analysis that accounts for the risk and uncertainty of a system by including the variability in the inputs.

A It is a tool for building statistical models that characterize relationships among a dependent variable and one or more independent variables. Monte Carlo simulations can be a useful tool to uplevel your red teaming skills and provide a different and fresh perspective for highlighting discussing and presenting findings. Though the simulation process is internally complex commercial computer software performs the calculations as a single operation presenting results in simple graphs and tables.

A Monte Carlo simulation is a model used to predict the probability of different outcomes when the intervention of random variables is present. Monte Carlo simulation is a computerized mathematical technique to generate random sample data based on some known distribution for numerical experiments. Probabilities must be at most two decimal places D.

Monte Carlo simulation involves the following stepsI Step 1. The Monte Carlo Method was invented by John von Neumann and Stanislaw Ulam during World War II to improve decision making under uncertain conditions. OCW is open and available to the world and is a permanent MIT activity.

Simulate thousands of valuation outcomes for the underlying assets. Which of the following best defines Monte Carlo simulation. Which of the following best describes a Monte Carlo simulation.

1 Which of the following best defines Monte Carlo simulation. Red Teaming and Monte Carlo Simulations. Monte Carlo Simulation Demystified.

Run a simulation for each of the N inputs. C Neither I nor II. A novice gambler who plays craps for the first time will have no clue.

MIT OpenCourseWare is a web-based publication of virtually all MIT course content. Monte Carlo Simulation is a mathematical technique that generates random variables for modelling risk or uncertainty of a certain system. Monte Carlo simulation in trading and investing is a statistical tool to measure uncertainty and how robust your strategy and backtest are for path sequences.

This method is applied to risk quantitative analysis and decision making problems. Monte Carlo simulations can be best understood by thinking about a person throwing dice. Monte Carlo Simulation with correlated random variables.

Each of the above is true ANSWER A. Monte Carlo simulation performs risk analysis by building models of possible results by substituting a range of valuesa probability distributionfor any factor that has inherent uncertainty. It typically involves a three-step process.

Randomly generate N inputs sometimes called scenarios. Different iterations or simulations are run for generating paths and the outcome is arrived at by using. Since most complex simulations are implemented on digital computers a rudimentary acquaintance with computer programming will probably be an asset to the readers of this book though no computer programs are included Chapter 1 describes concepts such as systems models and the ideas of Monte Carlo and simulation.

The simulated probability distribution will be the same as the actual probability distribution B. Which of the following defines how employees should use the organizations computing resources. Red teaming is about challenging an organization.

The simulations can make a model of the different outcomes of your trades if they had taken a different path or sequence. It is a tool for building statistical models that characterize relationships among a dependent variable. Simulations are run on a computerized model of the system being analyzed.

This computational algorithm makes assessing risks associated with a particular process convenient thereby enabling better decision-making. Which of the following best describes ROI. The simulation uses a mathematical model of the system which allows you to explore the behavior of the system faster cheaper and possibly.

A probability distribution describes the range or domain of possible values that a variable can have and also the probability or likelihood of a particular value in this domain being observed. Monte Carlo simulation ensures that.

Devize For Cloud Based Monte Carlo Simulation In 2021 Reviews Features Pricing Comparison Pat Research B2b Reviews Buying Guides Best Practices Cloud Based Predictive Analytics Standard Deviation

Monte Carlo Simulation Prepnuggets

Market Forecasting Monte Carlo Based Forecasting How To Deal With Uncertainty

Outline Of The First Step Of Monte Carlo Simulation Algorithm To Obtain Download Scientific Diagram

Pdf Monte Carlo Simulations In Radiotherapy Dosimetry

Flowchart Illustrating The Monte Carlo Simulation Algorithm With Download Scientific Diagram

Worst Case Circuit Analysis With Monte Carlo Simulation Maple Application Center

Outline Of The First Step Of Monte Carlo Simulation Algorithm To Obtain Download Scientific Diagram

Monte Carlo Simulation And Methods Introduction Goldsim

Monte Carlo Simulation Of Rnm Of 6t Sram Cell Download Scientific Diagram

Budgeting With Monte Carlo Simulation Models

Strengths And Weaknesses Of Monte Carlo Simulation Models Download Table

Chapter 10 Monte Carlo Simulation And The Evaluation Of Risk Ppt Download

Monte Carlo Simulation Using Microsoft Excel To Estimate The Probability Of Passing Usp Dissolution Test Ivt

Outline Of The First Step Of Monte Carlo Simulation Algorithm To Obtain Download Scientific Diagram

Monte Carlo Simulation An Overview Sciencedirect Topics

Monte Carlo Methods And Simulations Explained In Real Life Modeling Insomnia By Carolina Bento Towards Data Science

What Is The Monte Carlo Technique Quora

Chapter 10 Monte Carlo Simulation And The Evaluation Of Risk Ppt Download

Comments

Post a Comment